Import from Iran to India: Compliance and Growth

- Ebrahim Bahrololoum

- No Comments

In the midst of today’s shifting geopolitics and complex economic realities, the long-standing trade ties between Iran and India continue to follow a path that is both challenging and deeply vital. This article takes a closer look at the opportunities for imports from Iran into India, a market that, despite political barriers and international sanctions, still holds enormous growth potential.

Our primary focus is to highlight how Indian businesses can confidently move beyond these restrictions by staying fully aligned with legal requirements and compliance standards, ensuring that trade flows not only continue but actually grow stronger. With key data, valuable insights, and a clear overview of Iran’s top export products, this piece offers practical guidance for navigating financial and logistical complexities.

Ultimately, the aim is not just to shed light on the obstacles, but also to share practical strategies and a forward-looking vision for the future of bilateral trade. By doing so, Indian importers can feel assured that investing in imports from Iran to India is not only possible but also a smart step toward securing a stronger position in this strategic market.

Free Import & Export Consultation

Overview of Imports from Iran to India

The trade corridor between Iran and India is not just a historic route; it has become a vital economic lifeline that, in 2025, is entering a decisive stage. This section provides an essential overview of current imports from Iran to India, highlighting the strategic importance of these ties, rooted in geographic proximity and mutual economic needs.

Despite ongoing external pressures, especially U.S. sanctions, bilateral trade continues, largely sustained through rial-rupee mechanisms and exemptions for essential and humanitarian goods. With crude oil imports from Iran to India facing significant restrictions, the focus this year has shifted toward diversifying the trade basket. Non-oil items such as dried fruits, nuts, industrial chemicals, and minerals now play a central role in these exchanges.

This overview sets the stage for a deeper look into key products, regulatory frameworks, and logistical challenges, factors that shape this complex yet rewarding partnership for Indian importers.

Top Products and Trade Statistics for Iran and India Trade

Despite sanctions, trade between Iran and India continues to grow impressively. In imports from Iran to India, the sharp decline in crude oil’s share has significantly reshaped the product mix. According to recent trade data (focusing on 2024 figures and 2025 projections), non-oil items such as petrochemicals and chemical products, including methanol and urea, have moved to the top of the list, forming the backbone of current trade flows.

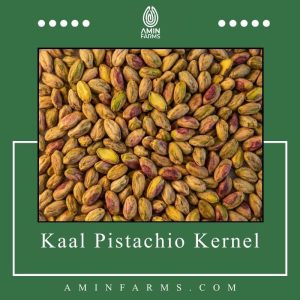

Beyond chemicals, Iran has established itself as a key supplier of agricultural and specialty goods to the Indian market—pistachios, dates, saffron, and cumin rank among the most in-demand imports. In the minerals sector, iron ore and certain industrial metals also play an essential role.

This shift clearly illustrates that, even with restrictions on imports from Iran to India, the real growth potential for 2025 lies in diversifying non-oil trade. For Indian importers, focusing on these high-demand products is the key to maximizing commercial gains.

Discover more: How to Find Buyers for Export from India

Navigating Regulations for Iran-India Imports

A successful entry into the Indian market with Iranian goods requires a clear understanding of the country’s complex legal and customs framework. The process of import from Iran to India is shaped not only by India’s general trade regulations but also by special protocols linked to bilateral agreements and certain international financial exemptions. Indian importers are required to obtain all necessary authorizations, including the Importer-Exporter Code (IEC) and product-specific certificates, depending on the type of goods.

For specific categories, mainly agricultural and food items, the import rules are stringent. Approvals from bodies such as the Food Safety and Standards Authority of India (FSSAI) are mandatory to ensure compliance with health and quarantine standards. At the same time, understanding customs duties and maintaining complete transparency in documentation are vital to avoid shipment delays or outright rejection.

Equally important is mastering the practical aspects of the process: registering orders, clearing goods through major ports such as Chabahar, and completing essential paperwork, including bills of lading, certificates of origin, and invoices. Taken together, these steps lay the foundation for navigating the next critical aspect of trade: managing sanctions and ensuring compliance with import restrictions from Iran to India.

Sanctions and Compliance Essentials

The biggest challenge in importing from Iran to India is managing the risks posed by international sanctions, particularly those imposed by the United States. These measures primarily target Iran’s financial, banking, and shipping sectors, making trade far more complex. For Indian importers, compliance is not just an option; it is an absolute necessity to avoid heavy penalties and the potential loss of access to the global financial system.

Effective compliance requires attention to two critical areas. First, financial management: most transactions rely on rupee–rial mechanisms or banks operating under special exemptions. Second, thorough inspection of goods and documentation: importers must ensure that their cargo is not listed among prohibited items under sanctions and that the origin paperwork is fully transparent. Equally important is identifying the ultimate beneficiaries in Iran to ensure that no transactions involve individuals or entities on the SDN List.

By carefully meeting these requirements, Indian businesses can navigate the challenges posed by import restrictions from Iran to India, securing both continuity and growth in this sensitive trade corridor.

Key Sectors Driving Bilateral Trade

Trade between Iran and India is no longer limited to oil alone. To ensure long-term stability and growth, it has become essential to diversify into key economic sectors and identify areas with substantial competitive advantages. This section highlights the leading industries that are not only more resilient to sanctions but also hold significant potential to expand imports from Iran to India in the coming years. Joint investments and a clear focus on these sectors will be crucial in overcoming current challenges and shaping a more prosperous future for bilateral trade.

1. Petrochemicals and Chemicals

After oil, this is the most significant contributor to Iran’s exports to India and forms the backbone of today’s trade flows. Products such as methanol, urea, and polyethylene, thanks to competitive pricing and easy availability, supply a significant share of India’s needs in agriculture (fertilizers) and plastics manufacturing. With steady, growing demand in India, this sector is considered one of the safest trade areas, especially as many of these goods benefit from sanctions exemptions or alternative payment mechanisms.

2. Agricultural Products and Dried Fruits

Iranian agricultural goods like pistachios, dates, saffron, and cumin hold a special place in the Indian market, driven by strong cultural and consumer demand. As essential or food-related items, they are less affected by strict financial restrictions, making them one of the most reliable pillars of non-oil trade. Indian importers in this sector seek high-quality, standardized packaging and a consistent supply.

3. Minerals and Construction Materials

With India’s growing demand for infrastructure and urban development, imports of iron ore, cement, and other raw minerals from Iran are steadily rising. Iran’s abundant and competitively priced mineral resources, combined with short sea routes, primarily through Chabahar Port, make transporting these bulky goods cost-effective. This positions the sector as a significant area for bilateral logistical investment.

4. Services and Transit

Though not a direct commodity, this sector acts as the engine behind bilateral trade. India’s investment in Chabahar Port and the development of the International North–South Transport Corridor (INSTC) represent critical service-related initiatives. They not only facilitate direct imports from Iran but also connect India to Central Asia and Afghanistan, boosting logistical cooperation and reducing transportation costs.

Logistics and Costs for Indian Importers

Success in importing from Iran to India heavily depends on optimizing the supply chain and managing costs with precision. The maritime route, primarily via the Chabahar port, is strategically important for its shorter distance and relative exemption from certain sanctions. This gives Indian importers the chance to bypass the more expensive traditional routes. That said, financial hurdles and sanction-related challenges inevitably add to operational costs.

Importers should be prepared for higher insurance premiums, as international insurers tend to be more cautious in such cases. Shipping expenses, particularly for bulk and containerized cargo, need to be calculated carefully by factoring in rates from Iran’s national shipping line (IRISL) or trusted Indian partners. On top of that, efficient paperwork management and faster clearance at Indian customs are critical; any delays could trigger hefty demurrage or storage fees, which can eat into profit margins. Finally, a clear understanding of the agreed Incoterms (like CFR or FOB) is key to keeping costs under control.

In short, while import restrictions from Iran to India create unique challenges, intelligent planning, strong risk management, and efficient execution can turn this trade corridor into a profitable opportunity.

Challenges and Solutions in Iran-India Imports

Successful trade along the Iran–India corridor requires a deep understanding of the challenges and proactive solutions to overcome them. This section highlights the most pressing issues — primarily financial and logistical — and offers practical ways to maintain a steady, sustainable flow of imports from Iran to India.

1. Banking Restrictions

Direct payments have become difficult due to limited access to international systems like SWIFT.

Strengthening rupee–rial settlement mechanisms, using barter arrangements, and relying on Indian banks with special authorizations can help reduce financial risks.

2. Insurance and Shipping

Sanctions have discouraged major international insurers and shipping companies, driving up insurance premiums and complicating freight options.

Leveraging the Chabahar port as a strategic route, along with the national shipping lines of both countries, provides a safer and more reliable channel for cargo movement.

3. Compliance

There’s always a risk of unintentionally violating U.S. secondary sanctions.

Regular compliance audits and thorough due diligence on trade partners, especially checking against the SDN List, are vital to staying on the safe side.

In short, navigating this trade corridor isn’t without hurdles, but with the right strategies in place, businesses can turn challenges into opportunities and build a resilient trading partnership.

Future Trends in Iran-India Trade

The future of imports from Iran to India depends on the sustainability of alternative routes and the deepening of strategic bilateral cooperation. The focus is expected to shift entirely from oil exchanges to non-oil trade and product diversification, bringing greater stability to overall trade volumes.

Two key trends are on the horizon. First, the development of transit corridors: the full completion and activation of Chabahar Port and the International North–South Transport Corridor (INSTC) will not only reduce logistics costs but also connect India to Iran’s regional trade networks. Second, strengthening local payment mechanisms, including broader use of the rial and rupee, aims to bypass international banking hurdles.

In this context, partnering with professional Iranian suppliers who understand compliance requirements and Indian quality standards is crucial. For instance, companies like Amin Farms are recognized for providing agricultural and dried fruit products, such as pistachios and dates, with a focus on export standards, ensuring long-term trade sustainability with Indian importers. These trends demonstrate that, despite ongoing restrictions on imports from Iran to India, the growth potential of this trade corridor remains strong.